Wise: Your Trusted Solution for International Money Transfers

Wise has become a top choice for individuals and businesses needing a reliable way to manage international money transfers. Over the years, my personal experience with Wise has been remarkable. The service is not only trustworthy but also highly efficient. Many friends and family members, to whom I’ve recommended Wise, have shared positive experiences and gratitude for the suggestion. Best International Money transfer Method !

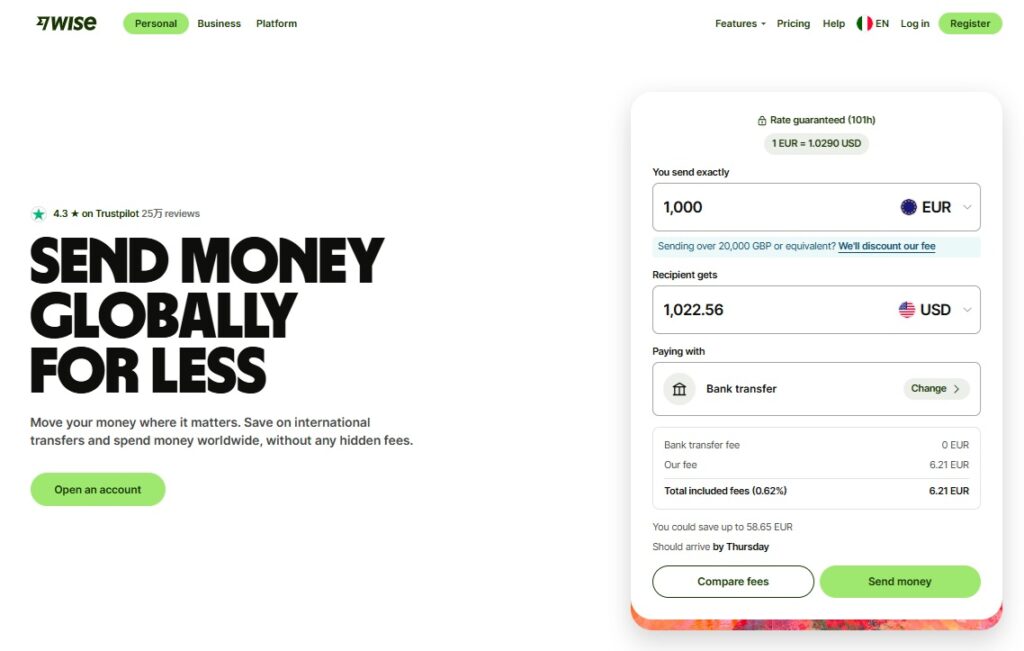

Affordable Transfers for Everyone

One of Wise’s standout features is its ability to dramatically lower costs when sending money internationally. Traditional banks often charge high fees and offer poor exchange rates. In contrast, Wise saves you up to 10 times more on international transfers. Additionally, their innovative system bypasses the SWIFT network, making local transfers cheaper and faster. Thanks to Wise’s transparency, there are no hidden charges. You always know exactly how much you’re paying. Best International Money transfer Method !

Quick and Reliable Transactions

Wise is widely praised for its fast transfer speeds. Instead of waiting days, transactions are often completed within hours. This is essential when you need your money to reach its destination quickly, whether for personal needs or business obligations. Furthermore, Wise’s user-friendly app and website make managing transfers simple and seamless. You can handle transactions easily, no matter where you are.

Multi-Currency Accounts for Global Convenience

Another key benefit of Wise is the option to open multi-currency accounts. With this feature, you can hold and manage funds in over 40 currencies. This is especially convenient for travelers and business professionals working internationally. Moreover, you can receive payments without conversion fees unless you choose to convert the funds later. Managing multiple currencies feels effortless—like having several bank accounts without the added complications.

The Wise Card for Frequent Travelers

If you travel frequently, the Wise card provides added convenience. You can spend money globally at the best exchange rates available. This ensures you get more value for every currency. Additionally, the card allows secure purchases and easy access to your funds at ATMs worldwide. For any traveler, the Wise card is an essential tool.

A User-Friendly Experience

Wise offers a streamlined platform designed for ease of use. The app is intuitive and simple to navigate, letting you send money, check exchange rates, or manage multiple currencies effortlessly. Moreover, their customer support team is always ready to assist with any inquiries or issues, ensuring a hassle-free experience.

Why Wise Stands Out for International Transfers

My experience with Wise has been overwhelmingly positive. The service consistently delivers significant savings, fast transactions, and unmatched convenience. Whether you need to send money abroad or plan to travel internationally, Wise empowers you to move funds without stress. Avoid hidden fees and poor exchange rates—choose Wise for smarter financial management.